The Best Guide To Paypal Business Loan

Wiki Article

Little Known Questions About Paypal Business Loan.

Table of ContentsFacts About Paypal Business Loan RevealedPaypal Business Loan Fundamentals ExplainedNot known Details About Paypal Business Loan Some Known Details About Paypal Business Loan The smart Trick of Paypal Business Loan That Nobody is Talking AboutRumored Buzz on Paypal Business LoanNot known Facts About Paypal Business LoanThe Paypal Business Loan PDFsMore About Paypal Business Loan

You will certainly be representing your service and stating your situation as to why the lending institution should consider you worthy of a finance. You will need to have a strong service plan as well as an in-depth description of just how you will use the cash.Don't forget to clothe expertly and also to ideal your pitch in person and also in writing, simply in case they need an on the internet funding application. The authorities in the financial market wish to see numbers, however they are human (mainly) and also can be won over by a good individuality as well as method with words.

Paypal Business Loan - An Overview

If you have a capital of $5000 each month and your lending repayments would certainly be $2500, your DSCR is 2 due to the fact that your finance settlement is half your income. The majority of lending institutions want a DSCR score greater than 1. 5. Needless to say, the greater your DSCR, the much better your chances of obtaining the lending.

Paypal Business Loan Fundamentals Explained

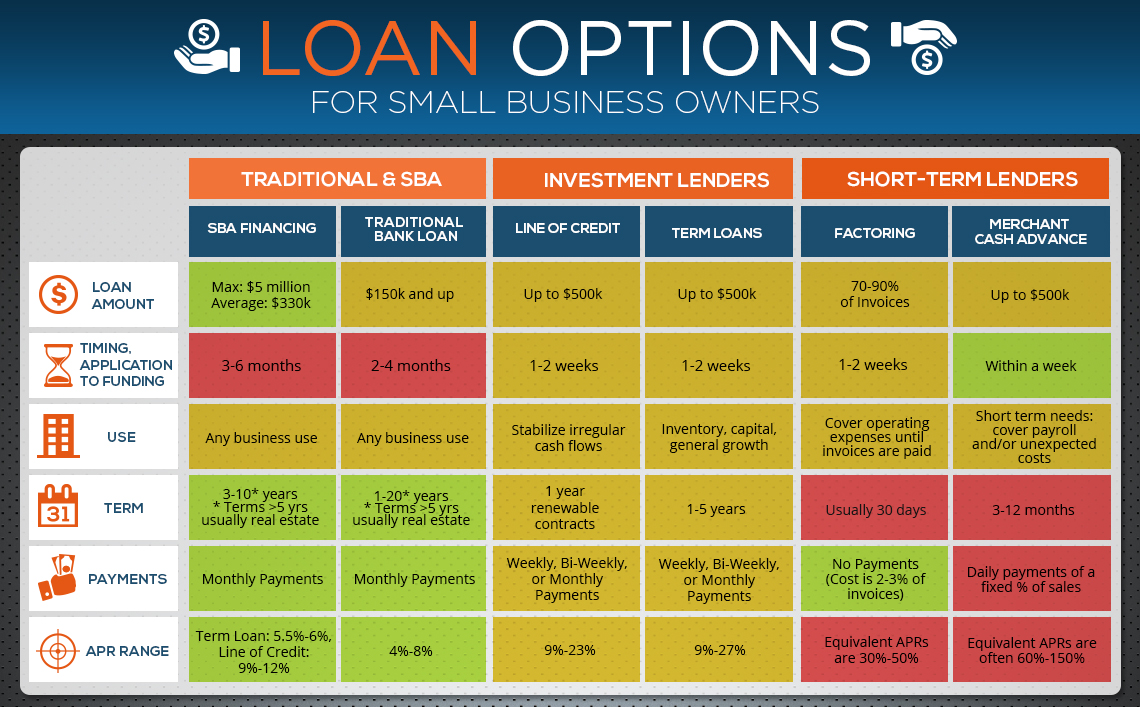

Not just does this show that you think sufficient in your very own business to put your possessions on the line, however occasionally the company does not have enough collateral to cover the loan quantity. If you want others to risk their financial resources for your business, you need to be ready to risk your very own. PayPal Business Loan.This is specifically true when you are taking a look at the different sorts of financings available to you. Right here are numerous of one of the most typical kinds of small company fundings: The united state Small Business Management developed this loan program to assist create more business chances in the country as well as, subsequently, advertise a much better economic climate.

The Basic Principles Of Paypal Business Loan

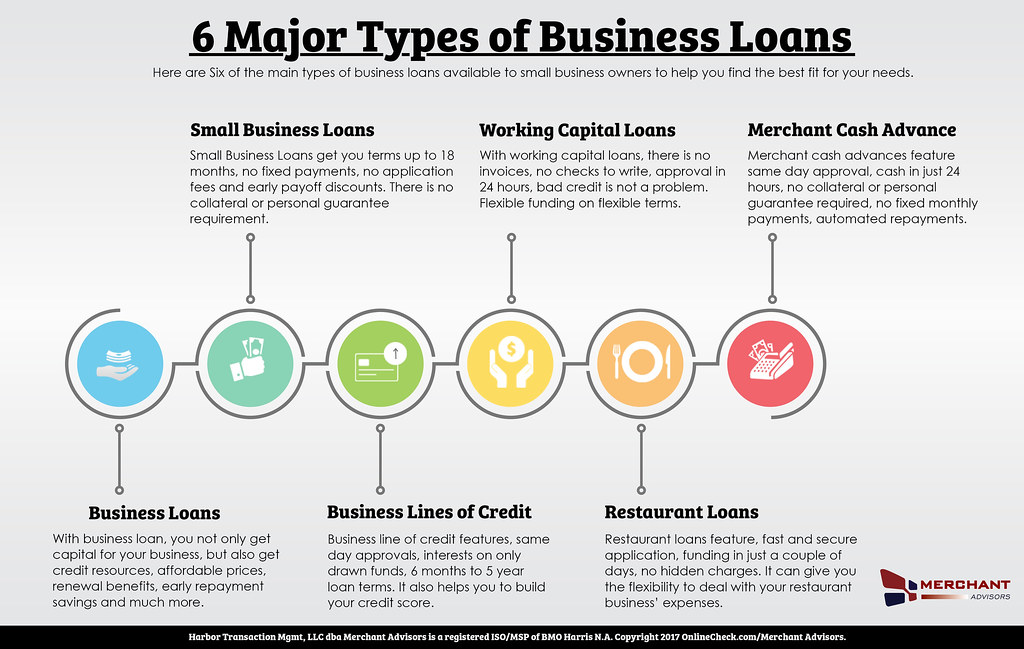

These finances are typically secured by business possessions. Recipients have the flexibility to make use of these funds for whatever company needs they please. A functioning capital funding is a short-term funding to aid the service keep afloat when capital is short. These finances can be used to pay pay-roll, business expenses, or financial obligation.However, you need to be aware that you will certainly be expected to pay the finance back in complete instead swiftly (usually less than twelve month). This type of funding is similar to a personal charge card, yet it is available in the type of a separate bank account his explanation for your business.

Paypal Business Loan - An Overview

It is very adaptable however usually features a higher rates of interest. When searching for a tiny company car loan, there are a couple of various points that you need to maintain your eyes and ears open for. Allow's break down these aspects of a financing as well as just how the different types of lendings place for these factors.The longer you need to wait to receive your funding, the even worse your financial scenario can get. If you remain in dire requirement of money to keep your service afloat, the speed of financing should be among the top priorities in your selection of funding. The fastest method of company financing is a seller cash loan.

Paypal Business Loan - Truths

As wonderful of an offer as SBA fundings are, this is where they drop short. SBA fundings can take months to process.

The Basic Principles Of Paypal Business Loan

Large financial institutions normally have more stringent requirements, making it much more challenging to safeguard financing. They can typically provide better prices, and you'll understand that you are obtaining from a relied on source. Small financial institutions might my review here be more happy to lend to services in their home town because they recognize the firm as well as the organization owner.And also, it can be stressful to consider exactly how challenging and also extensive the payment of these financings can become. Nobody intends to gather business debt. If you are cautious regarding dedicating to a bank loan, you do have some service financing alternatives that are a little less complicated to safeguard (as well as often a lot more economical).

Paypal Business Loan Can Be Fun For Anyone

You also have the flexibility to obtain when you need from the assent as well as prepay when you have surplus funds. Right here, you pay interest only on the quantity used.

Everything about Paypal Business Loan

The fast solution is "Very crucial". When it concerns small company financing, proprietors and their business are seen as one-and- the- exact same. Tiny business owners normally put in a lot of impact over their company so lenders put a hefty emphasis on the owner's credit report profile. The far better your credit scores background and credit history (FICO), the much better the possibilities you will certainly get a finance; and also, likely on much better terms.Report this wiki page